Equity Researcher

& Founder

Education

Experience

Specialization

My Top Returns

Live Return:As of October 8 2025 3:43 PM

My Current Top Picks

Live Return:As of October 8 2025 3:43 PM

Latest Equity Reports

Celsius® Strategic Project Feasibility Report

A corporate finance proposal assessing the feasibility and financial viability of Celsius opening a branded premium gym, using capital budgeting and strategic analysis.

StockTrak Portfolio Management Competition

3316 Investment Management Competition

Achieved 1st place out of all 3316 sections competing student portfolios in a 9-week market investment simulation using StockTrak.

Constraints

- 5–10% position limits per security

- Maximum 20% cash holding

- Diversified portfolio construction maintained throughout

9-Week Return

+14.27%

Sharpe Ratio

5.00

Full Report

Virtual Stock Exchange Competition Report

Strategy & Outperformance

Built an actively managed portfolio balancing high-growth tech bets with defensive sectors. Emphasized disciplined stock selection, earnings catalysts, and diversification to manage risk.

- Sector Focus: Growth in Technology & Fintech, Stability from Financials & Defensive Assets, Opportunistic plays in Consumer Brands.

S&P 500

Return

7.06%

My

Return

14.27%

Portfolio

Outperformance

+7.21%

Dow Jones

Return

7.90%

My

Return

14.27%

Portfolio

Outperformance

+6.37%

Nasdaq-100

Return

7.71%

My

Return

14.27%

Portfolio

Outperformance

+6.56%

Returns are from September 16th, 2024 to November 29th, 2024

Toolkit

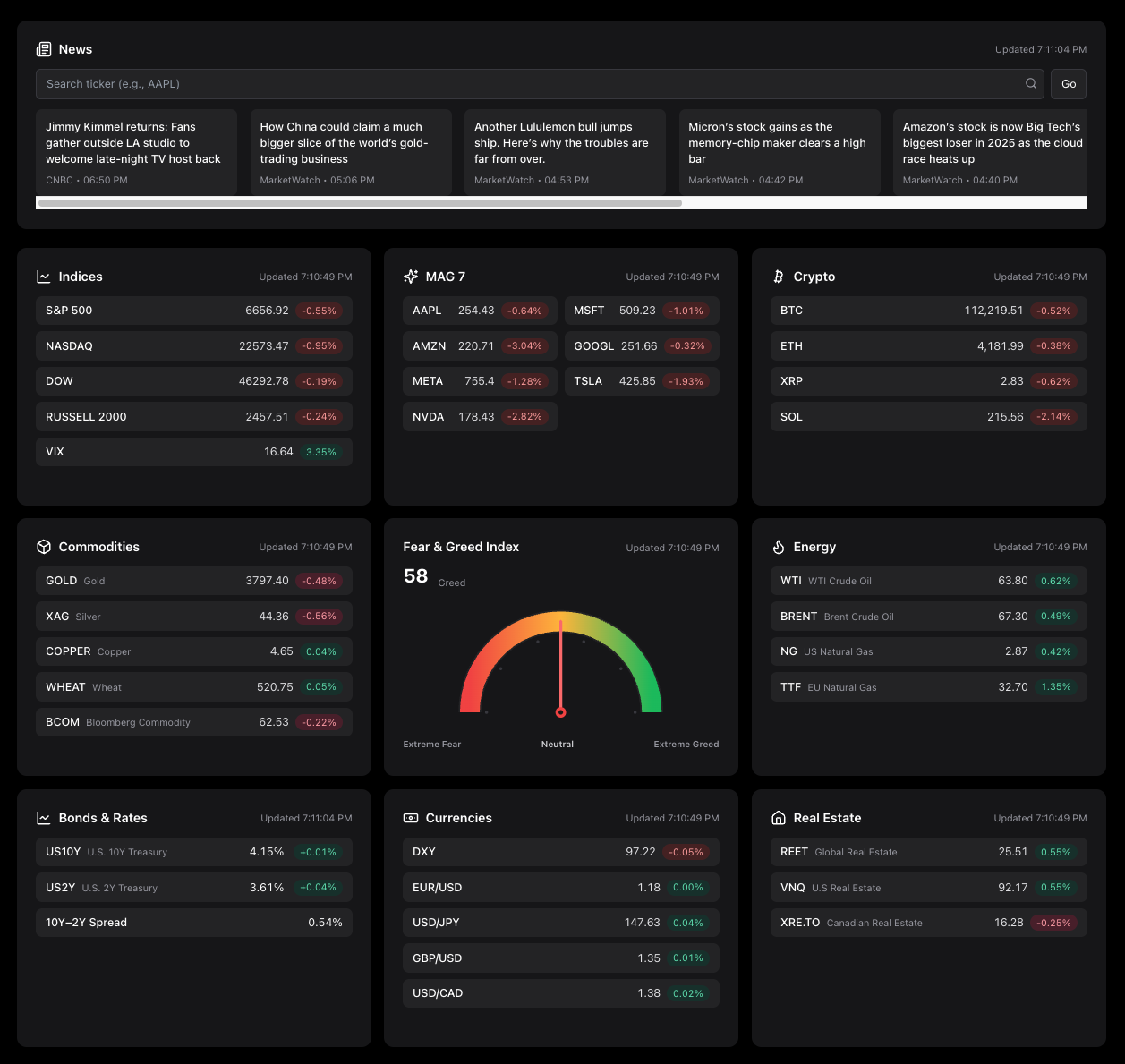

Bloomberg Market Concepts

Understanding in financial markets with Bloomberg, covering equities, fixed income, FX, and economic indicators.

Advanced Excel

Financial modeling, DCF modeling, LBO modeling, and valuation frameworks

Extensive Market Understanding

Deep expertise across global equities, macro trends, and industry shifts

Python

Data engineering, quantitative analysis, and automation pipelines

Adobe Suite

Creative direction, pitch design, and investor-ready storytelling

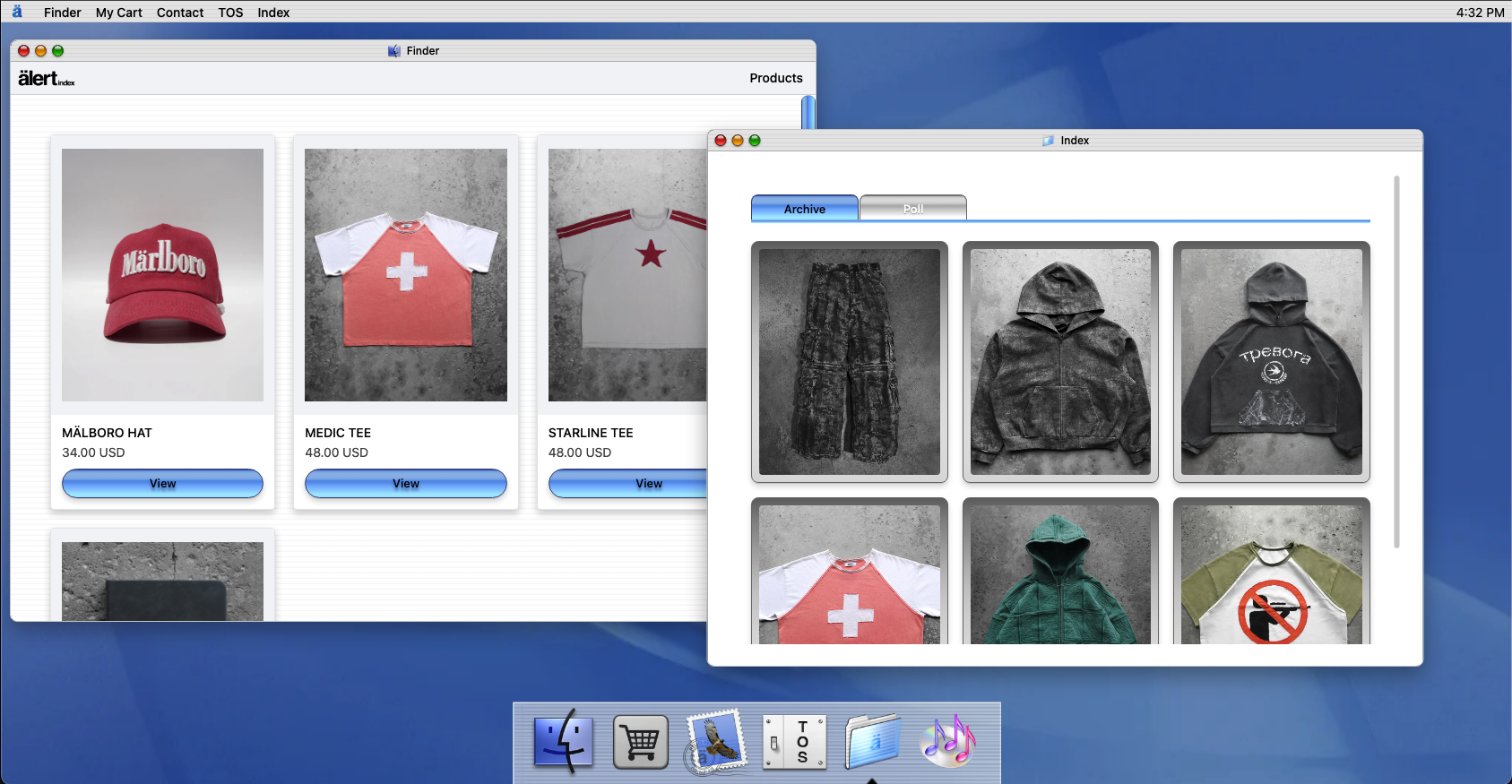

E-commerce Operations

End-to-end execution across merchandising, marketing, and fulfillment

Risk Management

Portfolio construction, hedging frameworks, and downside protection

Javascript

Data-driven web experiences and interactive investment dashboards

Open to Roles

Open to part-time, full-time, or contract. Quick reply; transcript and full CV on request.